Manage your Property like a Pro

With the best property management software in Canada, you can save time and money in your day-to-day operations. With us, you can manage your entire property portfolio from just one place. Start your free trial today.

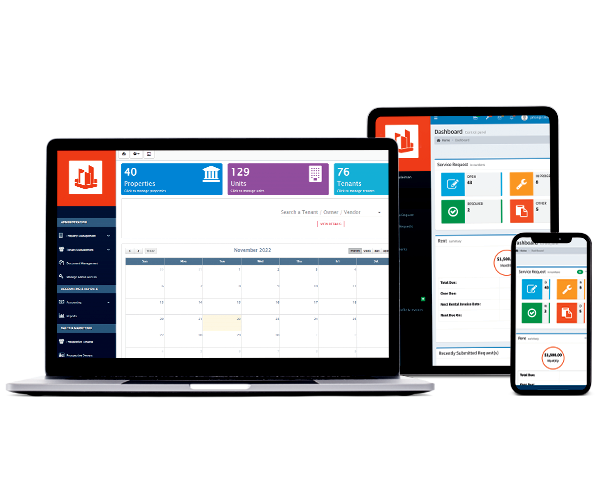

Available via Web Browsers, iOS 14, and Android 4.1+

Stay On Top of Your Business, From Anywhere

Canadian landlords and property managers can now easily manage their business operations from anywhere in the world. All you need is an internet connection to access the best-in-class property management functionality. Get the best-in-class services with our property management software.

A Property Management One-Stop-Shop

Our aim is to provide property managers with a single software solution from which they can manage every aspect of their business. No matter the size of your portfolio, our goal is to save you time and money by providing every feature you might need, all in one place, for an affordable price.

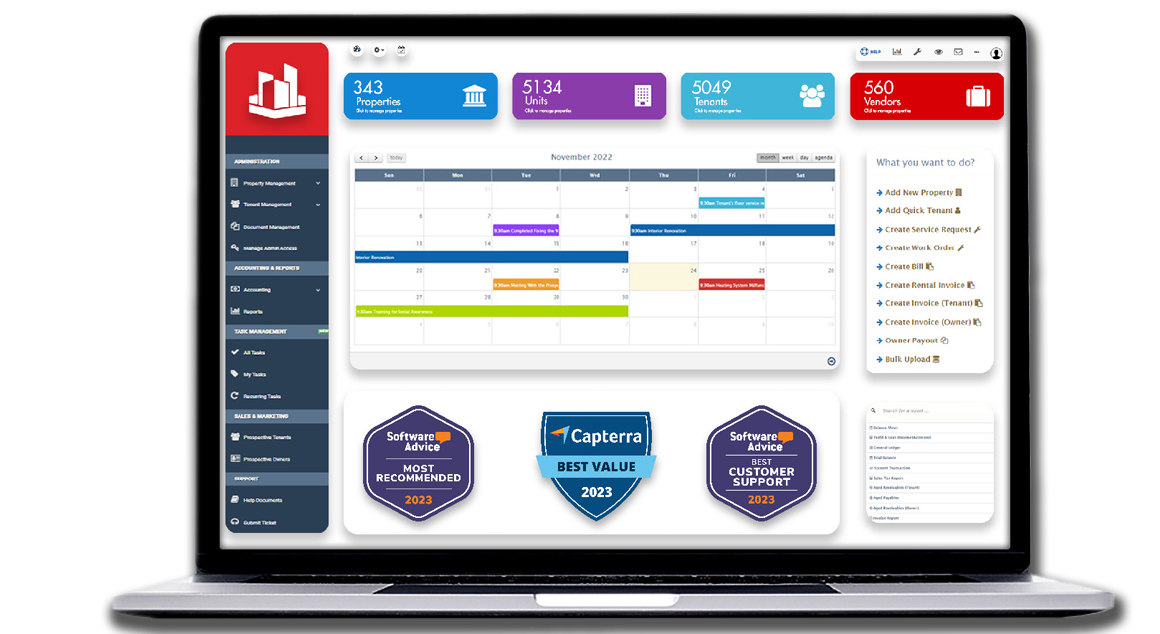

What Makes MiPropertyPortal Different?

MiPropertyPortal is the best Canadian property management software specifically designed for the Canadian property rental business. It does not only provide convenience and functionality but also streamlines your operations, reduces costs, and eliminates hassle, all while adhering to local regulations. What's more, our team specializes in the Canadian rental property industry, providing you with local knowledge and support whenever you need it.

100%

Real-time reporting capability

50%

More effective than any other property management software

100%

Local Canadian Support coast to coast 9-9EST

Increase Efficiency and Get More Business

MiPropertyPortal offers property management software designed to streamline business processes and increase transparency. Our customizable features allow you to personalize your user experience for the most appropriate and effective solution. By automating time-consuming and labour-intensive tasks, you can simplify your operations and focus on growing your business.

Made For Canadians

Our property management software is designed in accordance with provincial LTB regulations.

Local Canadian Support

Get 100% local Canadian support from our Customer Assistance Team

Secure Infrastructure

Built on the Microsoft cloud and with granular data security, we ensure that each user’s data and access is safeguarded

Advanced Technology

Stay on cutting edge technology at all times, and avoid costly and time-consuming upgrades and migration projects

Increase ROI

Save thousands of dollars on infrastructure and software licensing costs, and eliminate expensive software and hardware upgrades

Real-Time Notifications

Never miss a beat with real-time updates on all aspects of your property management business

Intelligent Cross Platform Design

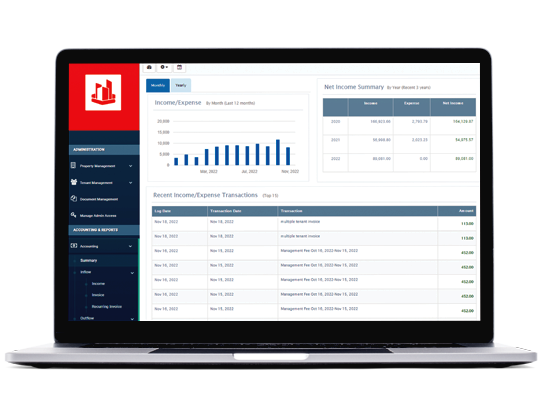

MiPropertyPortal’s user interface has been crafted to provide an aesthetically pleasing format and instinctive internal structure, so you’re never left weary of its use or hunting for a feature. Cross-platform adjustability delivers hassle-free access to our property management software, regardless of how you use it.

Real-Time Data At Your Fingertips

Our property management software provides you with a real-time connection to monitor all your accounting reports, rental updates, maintenance requests, leases, vendors, and more, from anywhere. You can securely access timely and sensitive information, enabling you to be the best property manager possible.

Our Property Management Software Features

Make the most of MiPropertyPortal and its industry-leading functionality by using it for all aspects of your property management business.

What our Clients tell About MiPP

MiPropertyPortal's main priority is customer satisfaction. Take a look at what our clients say about us!

Great Flexibility!

I have a Property Management Company in Vancouver and started working with Mi Property Portal in 2021 and it’s been a great experience from the very start. The entire team is very helpful and knowledgeable, responds quickly to questions and goes out of their way to give great service. My tenants and clients love the software program, it’s very professional and easy to use, and the automatic reports are a huge time saver! 5 stars all around, they are a great partner to have

-Vancity Flats, BC

Simple and Useful!

We are very happy with the support and client care provided by the entire team at MiPropertyPortal. They are great to deal with. We manage 400 units in Sudbury and started using MiPP when we just starting out. They continue to add new and exciting features that make it even easier for everyone to use. Jahangir is always very helpful and available to take our call whenever we need anything. Thank you MiPP for being a great partner!

-Greater Sadbury Property Management inc, ON

I love this Software!

This software program has everything you need! I was employed with the Provincial Government and the software program was not nearly as effective. Spectra TMS even Yardi, I haven’t experienced a software program like this. I am very pleased with the customer service and the ability to have a small portfolio without pressure from the company. The rates are great and you can grow with the program

-LMC, AB

Best property management software

This is a program that includes everything that you will need to manage your property. I love the prospective tenant that they fill out application, schedule viewings then write the lease all super easy to use. Automatic rent payments work perfectly everytime. Every email is recorded and all LTB forms are available to email right from the program. Customer service is within hours and even if you don't understand something they are there to help

- Cindy A, ON

All Star Software

Very easy to set up and use. Great customer support. I have nothing bad to say about the software. Fantastic on all departments, from purchase to operation.

- Barry P, NB

Excellent property management software

We moved to MiPropertyPortal from another company and immediately noticed that MiPropertyPortal was much easier to use and offered the ability to make and receive online payments. The interface is very nice and the data entry is very efficient and saves us a lot of time. Customer service is very responsive and they provided extensive training and support during the onboarding process and whenever we needed assistance.

Paradigm Property Management

Overall ease of use

I can find anything quickly and easily. I can add and edit. I can sort on a wide variety of variables to help me fine-tune my searches and reports. Customer service is top notch! Always get a speedy response and resolution.

- JDN Property

Exellent Property Management Software

Fantastic software, easy to use, no issues with rent collection and a great team always available to help.

- Brad P

We love MIPP!

The rent payment and owner payout processes are amazing.

- South Okanagan Property Management

Why Choose MiPropertyPortal?

If you are looking for easy-to-use, comprehensive Canadian property management software, then MiPropertyPortal is the platform for you. No other company provides the same level of service, catered specifically to the Canadian market.Flexible, Competitive Pricing

MiPropertyPortal offers Canadian property management software with affordable pricing tiers to choose from. You can find a package that suits your budget and specific needs, so you can manage your properties with ease and confidence.

MiPP Silver

$ 0.89 /mo/Unit+$69 Monthly Fee

Request Demo- 🗸Admin Portal

- 🗸Tenant Portal

- 🗸Tenant Screening

- 🗸Automated Forms

- 🗸Accounting

- 🗸Financial Reporting

- 🗸Service Request Tracking

- 🗸Lead Management

- 🗸Online Property Listing

- 🗸Online Rent Application

- 🗸Online Rent Collection*

- 🗸Lease Management

- Owners Portal

- Budgeting Tool

- Work Order Management

- Purchase Order Tracking

- Property Inspection

- Asset Management

- SMS

- Bank Reconciliation

- Cheque Printing

MiPP Gold

$ 1.19 /mo/Unit+$69 Monthly Fee

Request Demo- 🗸Admin Portal

- 🗸Tenant Portal

- 🗸Tenant Screening

- 🗸Automated Forms

- 🗸Accounting

- 🗸Financial Reporting

- 🗸Service Request Tracking

- 🗸Lead Management

- 🗸Online Property Listing

- 🗸Online Rent Application

- 🗸Online Rent Collection*

- 🗸Lease Management

- 🗸Owners Portal

- 🗸Budgeting Tool

- 🗸Work Order Management

- 🗸Purchase Order Tracking

- Property Inspection

- Asset Management

- SMS

- Bank Reconciliation

- Cheque Printing

MiPP Platinum

$ 1.39 /mo/Unit+$69 Monthly Fee

Request Demo- 🗸Admin Portal

- 🗸Tenant Portal

- 🗸Tenant Screening

- 🗸Automated Forms

- 🗸Accounting

- 🗸Financial Reporting

- 🗸Service Request Tracking

- 🗸Lead Management

- 🗸Online Property Listing

- 🗸Online Rent Application

- 🗸Online Rent Collection*

- 🗸Lease Management

- 🗸Owners Portal

- 🗸Budgeting Tool

- 🗸Work Order Management

- 🗸Purchase Order Tracking

- 🗸Property Inspection

- 🗸Asset Management

- 🗸SMS

- 🗸Bank Reconciliation

- 🗸Cheque Printing

Note! Prices are in Canadian Dollars. 0.50 for each EFT transaction.

Frequently Asked Questions

Not sure which plan is right for you? Reach out to us! We are here to help you find the perfect plan for your needs.

1. Do you offer a free trial?

Yes. We have faith in our product and offer potential users the chance to see it in action for themselves before they sign up or pay a dime. Go to our “Request Demo” page to find out how you can start your free trial right away.

2. How does the 7-day free trial work?

When you sign up for your free trial of our software you will instantly get full access to our system. We will email you when the trial expires. You may then select a plan and pay by credit card to continue using the product if you so wish.

3. How do we charge?

Our rates are per unit per month and depend on which package you choose. For example if you sign up for the Platinum package for 100 units your monthly bill would be: $69 monthly fee + (100 units x $1.39 per unit) = $208.

4. How much do you charge for tenant screening?

Each successful tenant screening report is $22.99. Either the tenant or landlord can pay for the screening application. We collaborate with SingleKey to provide you with the fastest tenant credit and background check reports in Canada.

5. Do I need a credit card to sign up?

You do not require a credit card to sign up for the 7 day free trial. However if you would like to continue using the software once the trial has expired you will need to input credit card details.

6. Do you charge for online rent collection?

Yes. For Pre-Authorized Debit (PAD) we charge $0.50 per transaction. Credit card processing costs 2.75% + $0.20 transaction fee. There is a $49 one-time setup free that applies for each payment type. All charges are in Canadian Dollars.

Still have a question? View full FAQ